NEW DELHI. India’s affordable 5G smartphone market has undergone a seismic shift, with the budget segment (₹6,000–₹8,000) recording an unprecedented growth of over 1,900% in 2025. According to the latest year-end analysis by CyberMedia Research (CMR), 5G technology has officially transitioned from a premium feature to a mass-market essential. While the overall smartphone market saw a marginal 1 per cent dip in volume, the rapid adoption of high-speed connectivity has redefined consumer behavior across the country.

India’s Affordable 5G Smartphone Market

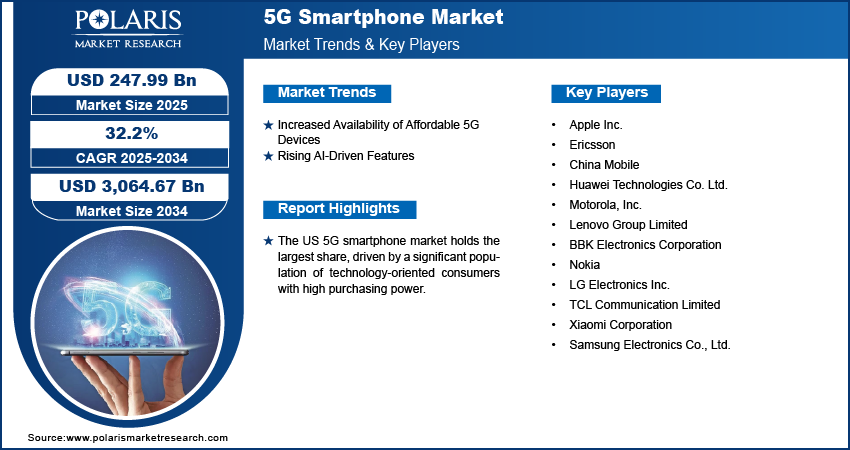

The CMR report highlights that 5G-enabled devices accounted for a dominant 88 per cent of all smartphone shipments in 2025. This reflects a significant increase from 76 per cent in the previous year. Consequently, the entry-level 5G category has become the primary engine of growth for the industry. This surge was largely driven by aggressive product launches from major brands and the increasing availability of low-cost 5G chipsets.

Furthermore, the migration from legacy tech is accelerating. Shipments of 4G feature phones plummeted by 48 per cent as users increasingly opted for India’s affordable 5G smartphone market offerings. This transition underscores a nationwide demand for better digital experiences, fuelled by expanded 5G network coverage and competitive data pricing.

India Smartphone Market Stats (2025)

| Category | 2025 Performance | Market Impact |

|---|---|---|

| Affordable 5G Segment | >1,900% Growth | Redefined entry-level market standards |

| Total 5G Share | 88% of Shipments | 5G is now the default for Indian buyers |

| Vivo Market Share | 19% | Retained #1 position in India |

| Apple YoY Growth | 25% | Significant expansion in premium tier |

| 4G Feature Phones | 48% Decline | Rapid migration to entry-level 5G tech |

Vivo and Samsung Maintain Dominance

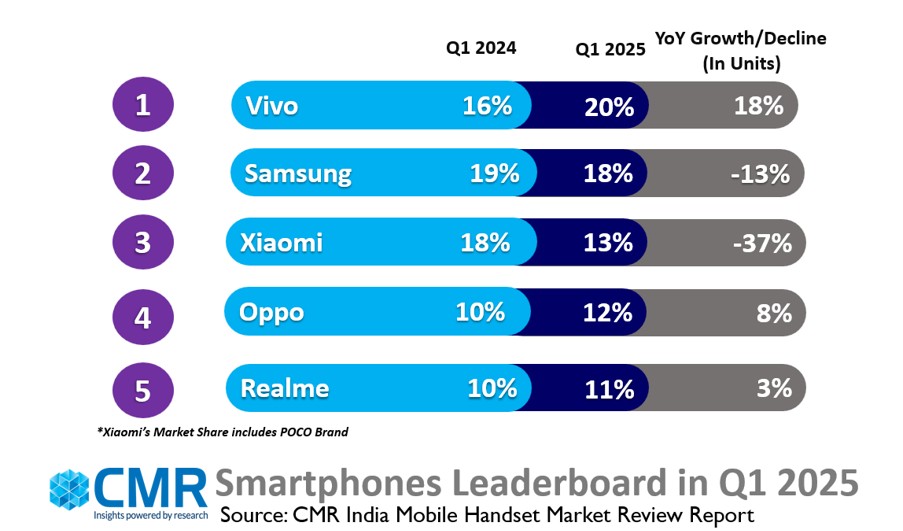

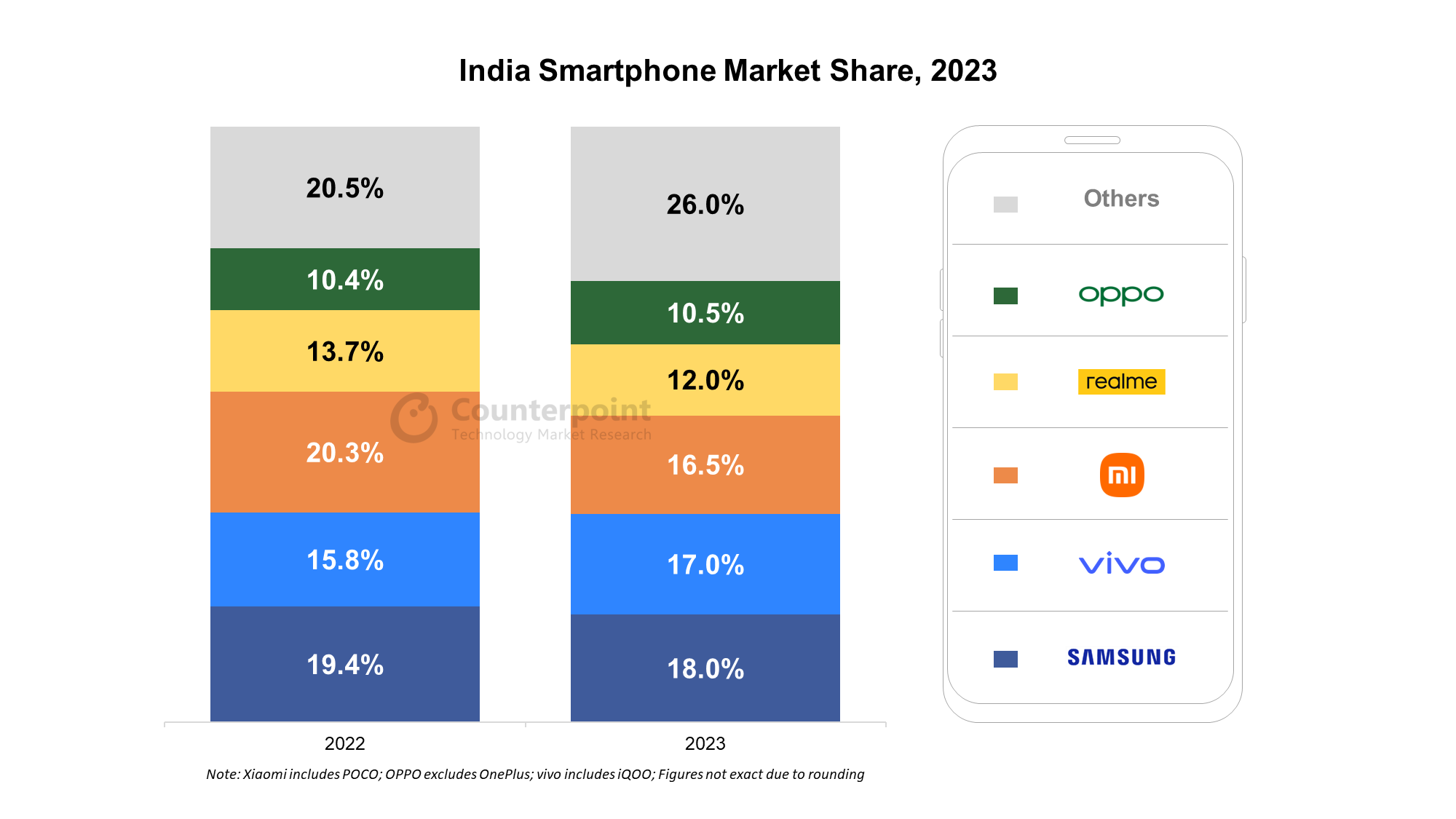

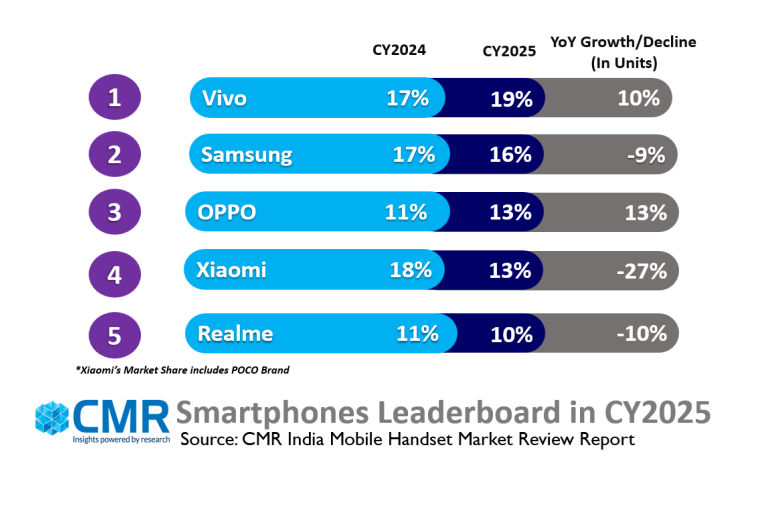

In terms of brand performance, Vivo secured the top position in the overall market with a 19% share, also leading the 5G segment. Samsung followed closely in second place with 16%, maintaining a strong presence in the mid-to-high 5G categories. Meanwhile, OPPO and Xiaomi both captured 13 per cent of the market share.

Leading smartphone brands driving India’s affordable and mid-range 5G market

Notably, the premium segment saw a remarkable performance from Apple, which grew by 25% year-on-year. The base iPhone 16 model emerged as a top seller, contributing to nearly half of Apple’s total shipments in the country. Additionally, emerging brands like iQOO and CMF recorded growth rates of 81% and 78%, respectively, signaling a shift in Gen-Z brand loyalty.

Hardware Trends and 2026 Projections

Consumer preferences in India’s affordable 5G smartphone market are leaning toward high-performance specifications. Data shows that 80% of smartphones shipped in 2025 featured displays of 6.7 inches or larger. Additionally, approximately 33% of new devices were equipped with massive 6000mAh batteries to support intensive 5G usage.

Looking ahead, industry experts predict a “cautious” 2026. While the momentum for 5G remains strong, rising costs for semiconductor components and memory are expected to exert pressure on device pricing. Therefore, manufacturers are likely to focus on AI integration and software longevity to maintain consumer interest as replacement cycles potentially lengthen.