The GST Council approved a major rate cut, targeting the road transport and auto sector. This reform benefits manufacturers and farmers. It also aids MSMEs and transport operators. Lower prices spark demand for two-wheelers and cars. Jobs surge in manufacturing and logistics. The Make in India initiative gains strength. Cleaner mobility options emerge as a priority.

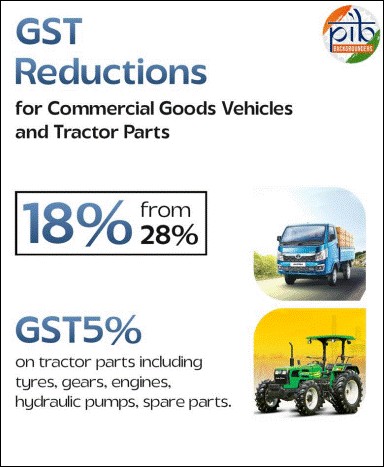

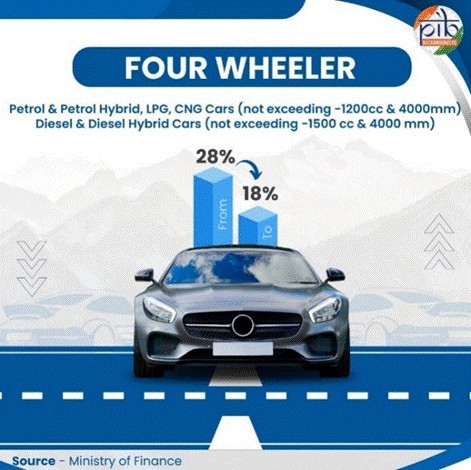

The council reduced GST rates significantly. Two-wheelers under 350 cc now face 18% GST. Small cars also drop to 18% from 28%. Large cars simplify to a flat 40% with full ITC. Tractors fall to 5% from 12%, aiding farmers. Buses with 10+ seats now cost 18%. Commercial goods vehicles also hit 18%. Auto components benefit with an 18% rate. Insurance for goods carriage drops to 5% with ITC.

Benefits Across the Ecosystemhttps://x.com/nitin_gadkari/status/1963293711263305926?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1963293711263305926%7Ctwgr%5E63a519c7b602c9ae763098da64eecc5f9566a936%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fwww.pib.gov.in%2FPressReleasePage.aspx%3FPRID%3D2165916

Employment soars with over 3.5 crore jobs supported. MSMEs thrive in tyres, batteries, and steel sectors. Drivers and mechanics gain new opportunities. Cleaner mobility pushes for fuel-efficient vehicles. Old, polluting models face replacement. Public transport adoption reduces emissions. Logistics improves with lower freight rates. Exports strengthen under PM Gati Shakti. Agriculture and e-commerce benefit greatly.

Sector-Wise GST Rate Changes

| Vehicle Category | Previous GST Rate | New GST Rate | Key Benefits |

| Two-Wheelers (<350 cc) | 28% | 18% | Affordable mobility for youth, rural households, gig workers. |

| Small Cars | 28% | 18% | Encourages first-time buyers, boosts sales in smaller towns. |

| Large Cars | 28%+ Cess | 40% (Flat) | Simpler taxation, full ITC eligibility, affordability for aspirational buyers. |

| Tractors (<1800 cc) | 12% | 5% | Strengthens India’s global tractor hub status, boosts farm mechanisation |

| Buses (10+ seater) | 28% | 18% | Affordable public transport, supports fleet expansion. |

| Commercial Goods Vehicles | 28% | 18% | Lower freight cost, reduced inflationary pressures, stronger supply chain. |

| Auto Components | 28% | 18% | Stimulates ancillary MSMEs, boosts domestic manufacturing. |

| Insurance for Goods Carriage | 12% | 5% (with ITC) | Supports logistics, reduces operating costs for transporters. |

This reform marks a milestone for mobility. It lowers tax burdens on consumers. The auto ecosystem grows stronger. MSMEs receive a significant boost. Employment rises in urban and rural areas. The changes take effect on 22nd September 2025. India commits to a fairer GST framework. Citizens enjoy ease of living. Enterprises gain ease of doing business.